Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018. Here are some scenarios of the taxable period that may run.

Sales Service Tax Sst In Malaysia Acclime Malaysia

The Goods and Services Tax GST will be set to zero percent 0 effective from 1 June 2018 as announced by the Ministry of Finance Malaysia on 16 May 2018.

. The Malaysian government replaced GST with SST as of September 1 2018. Reclassifying the sale of newspapers journals and books as nil-rated Exempting local government services from GST Exempting from GST management and maintenance services for certain housing development. You should change all GST tax codes from 6 to 0 on 1st June 2018 onward.

On 16 May 2018 the Malaysian Ministry of Finance also issued a press release stating that supplies of goods and services made in Malaysia as well as goods and services imported into Malaysia which are currently standard-rated ie. GST which was also known as a value added tax in other countries was implemented and. It is replacing the 6 Goods and Services Tax suspended on 1 June 2018.

Declare in column 5 a of GST-03 because GST Zero-Rated Order 2014 is repealed. The recent changes that came into effect in 2018 include the following 4 compliance updates as follows. The existing standard rate for GST effective from 1 April 2015 is 6.

Since the introduction of GST in April 2015 there have been changes in the way we record and report GST. From changes in tax codes some added some removed to changes in the GST-03 as well as GST Audit File reporting formats. The Goods and Services Tax GST is an abolished value-added tax in Malaysia.

As such the rate reduction from the current 6 to 0 will be reflected on transactions related to MYXpats charges from 1 June 2018 onwards. GST registered persons must account for GST at 0 and declare the output tax in their final GST-03 return. The Malaysian 2018 Budget introduced a number changes to the Goods and Services Tax regime.

GST tax codes submission of GST returns for the respective taxable periods and claiming of input tax credit. The GST regime has been in place since April 1 2015. You must make a declaration of 6 standard rated sales before 01 June 2018 and 0 standard rated sales from 01 June 2018 in column 5 a of GST-03.

My taxable period is 01 April 2018 to 30 June 2018. Malaysia has tabled at Parliament the implementation bill for its Sales and Service Tax SST which comes into force on 1 September 2018. Once the tax rate changed any transaction which uses the amended GST Code will be 0 automatically.

First change the default tax rate Rate 2 of tax code such as G GST Code for SR and TX GST code from 6 to 0 then enter the old rate 6 in Rate 1 field and set the changeover date to 1 June 2018. Sage 300 Malaysia Business process management for all businesses. May 17 2018.

This article relates to the Goods Services Tax which was introduced in April 2015 but was subsequently replaced with the Sales Service Tax in September 2018. GST is charged on all taxable supplies of goods and services in Malaysia except those goods and services that are explicitly exempted. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy.

Apply to the SST regime. Input tax on purchases made from GST registered suppliers by local authorities or statutory bodies to perform regulatory and enforcement functions. From 1 June 2018 Malaysias Goods and Services Tax will be zero-rated while the Sales and Services Tax is expected to make a comeback.

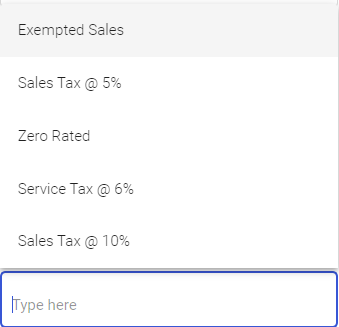

Malaysia GST Reduced to Zero. GST registered companies should also ensure that the pricing of goods and services is at all. GST Tax Codes for Purchases GST code Rate Description TX 6 GST on purchases directly attributable to taxable supplies.

Malaysia scrapping GST from June 2018. The switch is expected to cost the country an estimated at RM25 billion in lost revenues as only a fraction of the companies. Goods removed and invoice issued to the buyer on 28 August 2018.

Segala maklumat sedia ada adalah untuk rujukan sahaja. The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST will be reduced to 0 from the current 6. IM 6 GST on import of goods.

Such schemes under GST will not be applicable under SST. Does the provision of special schemes under GST such as ATS ATMS margin scheme etc. How should I declare the GST-03 return.

Subject to 6 GST would be zero-rated with effect from 1 June 2018 until further notice. For purchases with input tax where the GST registered entity elects not to claim for it. GST is also charged on the importation of goods and services into Malaysia.

GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. For more information regarding the change and guide please refer to. The Goods and Services Tax GST will be zero-rated for all items and services in Malaysia from June 1 2018 the Finance Ministry announced.

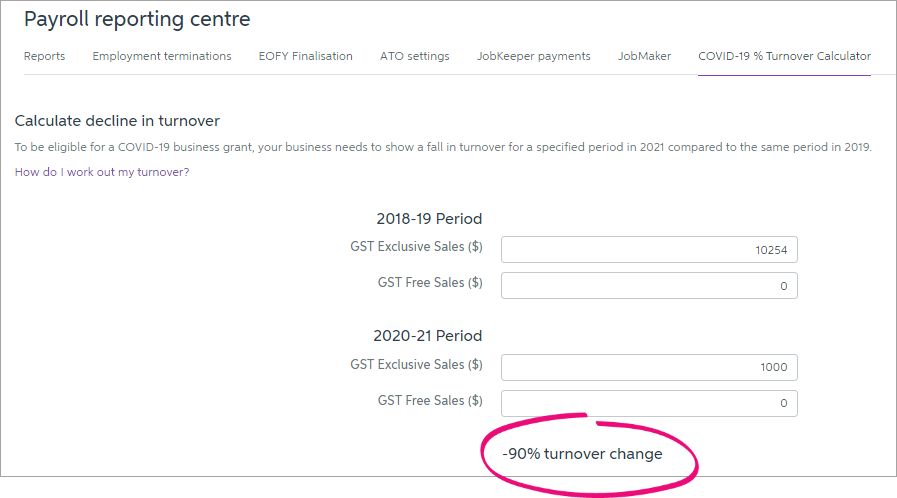

Working Out Turnover For A Covid 19 Grant Myob Accountright Myob Help Centre

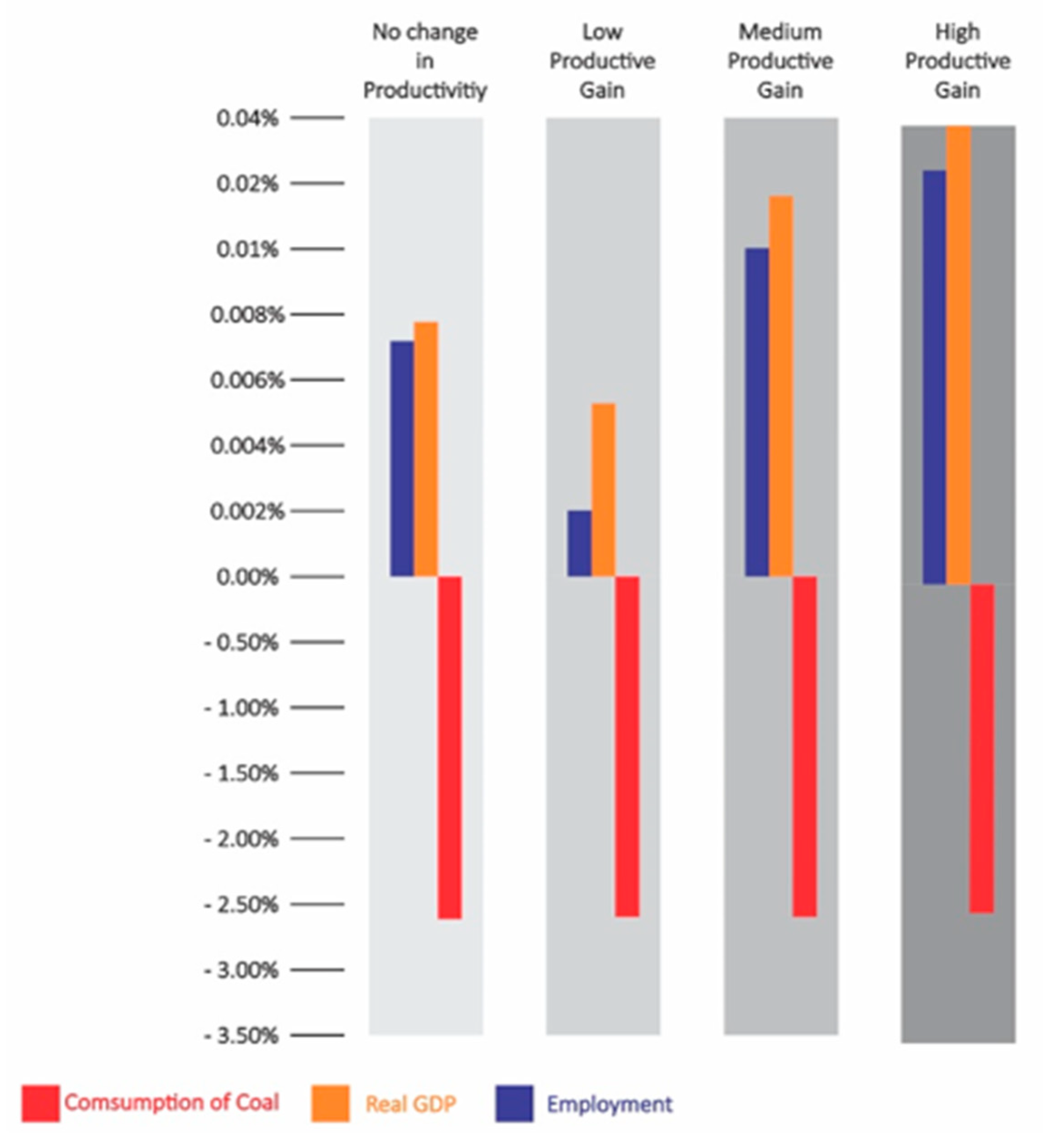

Sustainability Free Full Text Green Tax Reform In Australia In The Presence Of Improved Environment Induced Productivity Gain Does It Offer Sustainable Recovery From A Post Covid 19 Recession Html

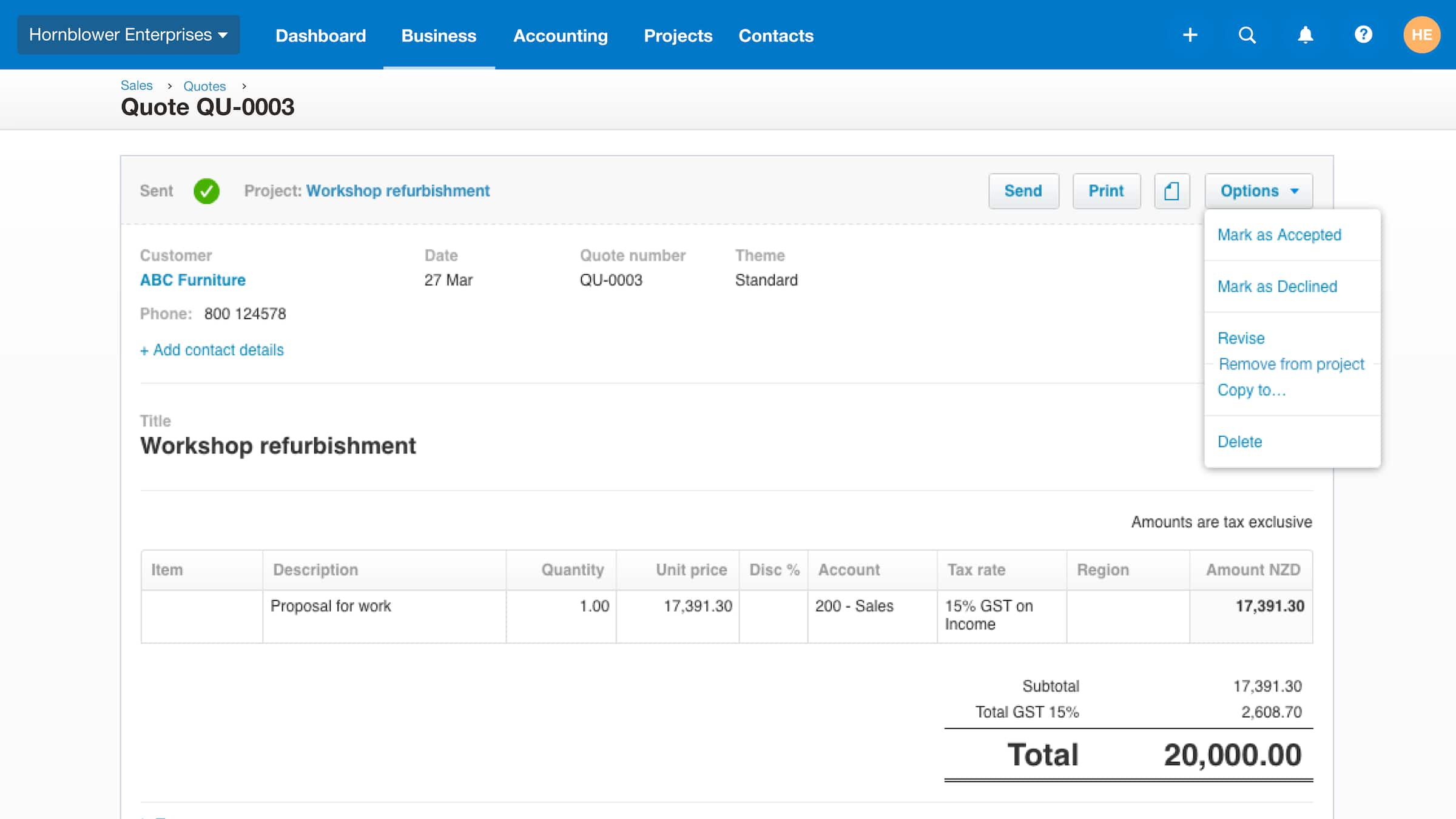

Reckon To Quickbooks Online Conversion Mmc Convert

Writing Off Bad Debts Myob Essentials Accounting Myob Help Centre

Writing Off Bad Debts Myob Essentials Accounting Myob Help Centre

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Malaysia Sst Sales And Service Tax A Complete Guide

Financial Statements Australian Financial Security Authority

Newsletter 22 2019 Gst Guide On Transition Issue Page 001 Jpg

The Amount Of Monthly Gst Collections Has Reached Trillion Marks For The First Time Since The Beginning Of Gst Registration Which Ind Trillion Marks Banksters

Notice From Gst Department Top Reasons Response Timing Eztax In Accounting Tax Services Accounting Software

Dianna Agron Looks Lovely In Louis Vuitton For Harper S Bazaar Malaysia Dianna Agron Glam Looks Model

Change Your Gst Basis Or Gst Registration Status Xero Central

Writing Off Bad Debts Myob Essentials Accounting Myob Help Centre

Malaysia Sst Sales And Service Tax A Complete Guide

Removing Gst On Feminine Hygiene Products Parliament Of Australia

Malaysia Sst Sales And Service Tax A Complete Guide